2022 And 2024 Roth Ira Contribution Limits. Roth ira contribution limits for 2023 and 2024. Roth iras have the same annual contribution limits as traditional iras.

In all three years, those who are age 50 or older can. If you’re age 50 and older, you.

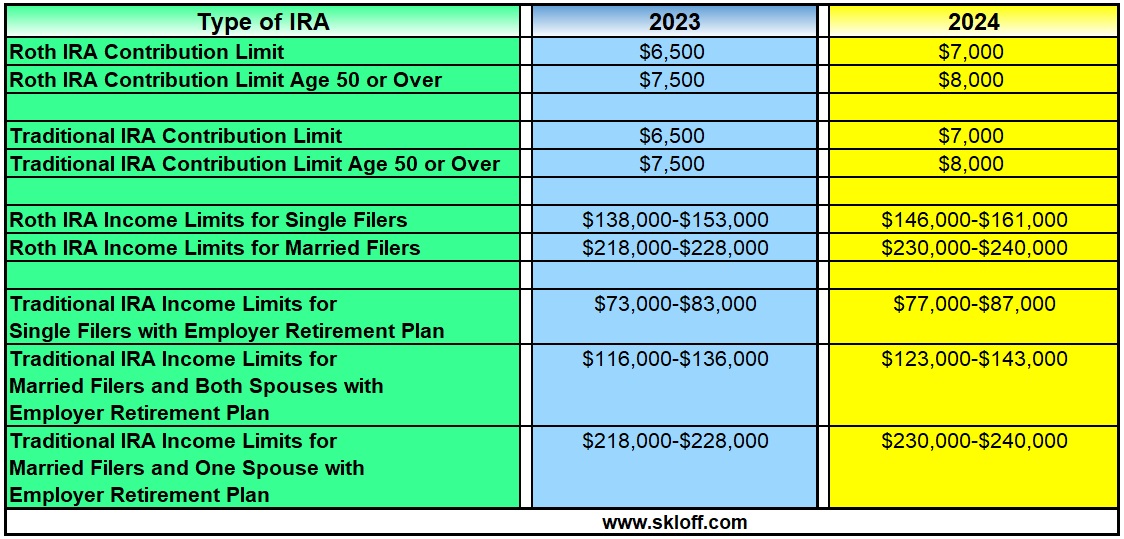

Roth Ira Contribution And Income Limits:

If you're age 50 and older, you.

Married Filing Jointly (Or Qualifying Widow(Er)) Less Than.

Your roth ira contribution might be limited based on your filing status and income.

If You’ve Hit The Roth Ira Contribution Limit, You Can Also Consider Contributing To A Roth 401(K).

Images References :

Source: choosegoldira.com

Source: choosegoldira.com

ira contribution limits 2022 Choosing Your Gold IRA, These figures have increased for the 2024 tax year, though. The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

Source: kimberlynwalvera.pages.dev

Source: kimberlynwalvera.pages.dev

Irs 529 Contribution Limits 2024 Rory Walliw, Roth ira income and contribution limits for 2024; Ira contribution limits for 2023 and 2024.

Source: choosegoldira.com

Source: choosegoldira.com

max roth ira contribution 2022 Choosing Your Gold IRA, But other factors could limit how much you can contribute to your roth ira. Roth ira contribution limits for 2023 and 2024.

Source: skloff.com

Source: skloff.com

IRA Contribution and Limits for 2023 and 2024 Skloff Financial, Limits on roth ira contributions based on modified agi. But other factors could limit how much you can contribute to your roth ira.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, The roth ira contribution limit is $7,000 in 2024. Roth iras have the same annual contribution limits as traditional iras.

Source: www.carboncollective.co

Source: www.carboncollective.co

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits, Ira account holders can contribute up to $7,000. You can add $1,000 to that amount if you're 50 or older.

Source: ee2022d.blogspot.com

Source: ee2022d.blogspot.com

2022 Ira Contribution Limits Over 50 EE2022, But other factors could limit how much you can contribute to your roth ira. These figures have increased for the 2024 tax year, though.

Source: incobeman.blogspot.com

Source: incobeman.blogspot.com

Limit For Roth Ira Contribution 2021 INCOBEMAN, Contribution limits roth ira roth ira roth vs traditional withdrawal rules contribution limits rollover ira rollover ira rollover options If you have a roth 401(k) plan and a roth ira, your total annual contribution across all accounts in 2023 cannot exceed $29,000 ($30,000 in 2024), or $37,500.

Source: jerrilynwlian.pages.dev

Source: jerrilynwlian.pages.dev

2024 Roth Contribution Max Agata Ariella, The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50. If you're age 50 and older, you.

Source: choosegoldira.com

Source: choosegoldira.com

self directed 401k contribution limits 2022 Choosing Your Gold IRA, The ira contribution limits have increased from $6,000 in 2022, $6,500 in 2023, and to $7,000 in 2024. For the tax year 2024, the maximum contribution to a roth ira is $7,000 for those younger than 50 and $8,000 for those who are 50 or older.

Contribution Limits Roth Ira Roth Ira Roth Vs Traditional Withdrawal Rules Contribution Limits Rollover Ira Rollover Ira Rollover Options

The ira contribution limits have increased from $6,000 in 2022, $6,500 in 2023, and to $7,000 in 2024.

In 2024, The Roth Ira Contribution Limit Is $7,000, Or $8,000 If You're 50 Or Older.

But there are income limits that restrict who can contribute.